“Plans are worthless, but planning is everything.”

— Dwight D. Eisenhower

Making predictions is a shitty business. The events leading up to the realization of any prediction make it seem less extraordinary. And when you get it wrong, you’re an insufferable numbskull. The value of a prediction is in the act of making it, not the prediction itself. Contemplating what may happen encourages us to take responsibility for decisions we make in the present. Also, revisiting a prediction and asking why it did/didn’t come to fruition provides insight into the machinations of our world and whether we are progressing or regressing.

“An economist is an expert who will know tomorrow why the things he predicted yesterday didn’t happen today.”

— Laurence J. Peter, Canadian writer & educator

So let’s review last year’s predictions to hold ourselves accountable. 2021 was a good year (maybe our best yet) in terms of understanding the world we might live in.

2021 Predictions Review

Apple Acquires Peloton

Predicted: Dec 2020

We envisaged Apple swallowing Peloton, and a transfer of two to four hours of attention/week of the most influential people in the West to iOS. Apple hasn’t bitten, but it could (and should). Its nearly $3 trillion market cap is 240 times larger than Peloton’s, i.e. whale to krill. And over the past 12 months, as Peloton stock has plummeted, the relative cost for Apple to acquire the company (i.e. dilution) has declined 90%.

Bitcoin Hits $50,000

Predicted: Dec 2020

Disco. We predicted this when BTC was at $22,000. The Gordon Sumner of cryptocurrencies breached $50,000 two months later. Crypto startups raised $32 billion-plus in venture capital in 2021, a fivefold increase from 2020. Bitcoin remains the bedrock of one of the fastest growing sectors in history, a hedge against inflation and FOBI (fear of being an idiot).

Twitter Hits $60, and Dorsey Is Ousted by June 2021

Predicted: Dec 2020

Twitter reached $60 and has since dropped. But the real win was corporate governance. It’s strange, as you age, what gives you joy — and this did. #Pathetic. A win for us (because we were right) and for shareholders, who will reap the benefits of having a CEO who doesn’t spend 90% of his time with his first family.

Restoration Hardware Hits $1,000, and Sonos Reaches $40

Predicted: Dec 2020

The pandemic catalyzed a dispersion that brought the office to the home. We predicted a commensurate reallocation of capital to home improvement and, with it, the stocks of companies such as Restoration Hardware and Sonos. Resto didn’t explode as we thought it would, but it still registered a 16% increase year over year. Sonos … did explode. It doubled in March to more than $40 and ended the year up 36%.

Airbnb Hits $200/Share and Enters Commercial Real Estate

Predicted: Dec 2020

We predicted this when Airbnb was $68 per share. The shares hit $200 within three months. We also predicted Airbnb would do to commercial real estate what it did to hotels. That is, disperse the value of centralized, asset-heavy real estate holders across a network of commercial properties. We’ll see.

We Might Work

Predicted: Apr 2020

Remote work represents a structural shift, and we believed 2021 would be the year of WeWork’s un-undoing. Correct. WeWork had a successful IPO in April at a more realistic valuation: $9 billion vs. its psilocybin-induced $47 billion valuation in 2019. The company also replaced desk-renting Jesus with Sandeep Mathrani. Meanwhile, 94% of Manhattan’s office workers are still hybrid or fully remote, and We’s model looks like it will endure as hybrid work becomes the new normal.

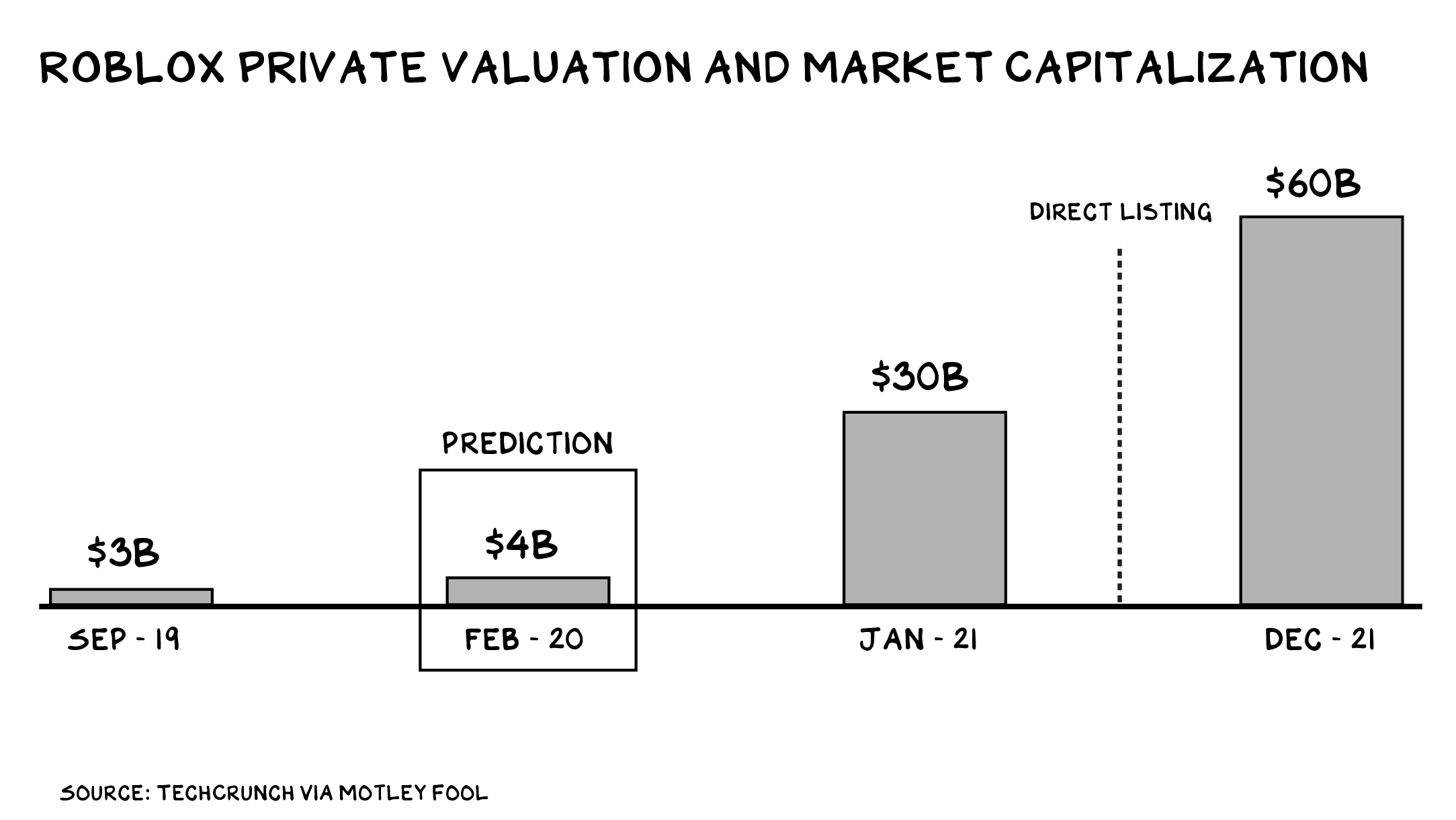

Roblox Stock Doubles from Its Offer Price Within Six Months

Predicted: Dec 2020

Twelve months ago, Roblox was a private company valued at $4 billion. Today its market cap is roughly $60 billion. The stock doubled from its reference price within three months of listing and continued to rise. Roblox has whipped up a typhoon of capital as it inspires interest in player-created virtual worlds. Roblox was Meta before (wait for it) Meta.

AT&T Divests Time Warner Assets

Predicted: Jan 2020

We predicted this two years ago after AT&T started junking up Time Warner’s luxury product (HBO) with a mess of variants (HBO Go, HBO Now, HBO Max) — the equivalent of Hermès selling JanSport backpacks next to Birkin bags. We were early on this one (a good thing). In May, AT&T announced it would spin off WarnerMedia and combine it with Discovery. The deal’s expected to be completed in mid-2022.

CNN Goes Behind a Paywall

Predicted: Dec 2020

Not only did we get this right … No Mercy/No Malice (the show) is going behind the paywall with it after the Bloomberg newsroom freaked out at my impression of the Village People. (Worth it.) If this sounds like another white guy failing up, trust your instincts. Tune into CNN+ this March, when I’ll become the Andy Summers to Chris Wallace and Eva Longoria’s Sting and Stuart Copeland. (Listening to a lot of The Police lately.)

OK, to infinity and beyond: 2022 predictions.

2022 Predictions (Teaser)

Join us on January 4 for the full experience (sign up here) — but here are the cliff notes.

“People can foresee the future only when it coincides with their own wishes.”

— George Orwell, British writer

The Zuckerverse Is the Biggest Tech Fail of 2022

The value proposition of exiting this reality for a new one is nihilistic — a symptom of an epidemic that’s infected the most fortunate people on the planet. Many of our tech billionaires,letting their inner child stunt their outer man, are focused on leaving this universe or creating an alternative one. This is not visionary; on the contrary, it’s void of the leadership we need to address the problems of this planet in this universe.

What’s more precarious, however, is the notion that we’d trust Zuckerberg to be our shepherd in this new world after he chipped away at the self-esteem of our children and harvested, leaked, and sold the personal data of more people than the population of Earth’s southern hemisphere plus India. The mortal who controls the envisioned metaverse would be rendered a god, and the Zuck is a first-ballot hall of fame candidate for people who deserve dramatically less power.

There are already several metaverses. The Appleverse boasts several thousand metaverses sitting on top of one of the most accretive business models in history (the app store) with a portal (Airpods) that ships 40 times as many orders as the Meta portal (Oculus). Apple has already submitted a patent to install a camera in its Airpods and is even experimenting with temperature sensors for health monitoring. The Airpods business alone generates roughly $12 billion a year, more than Shopify, Snap, and Twitter combined.

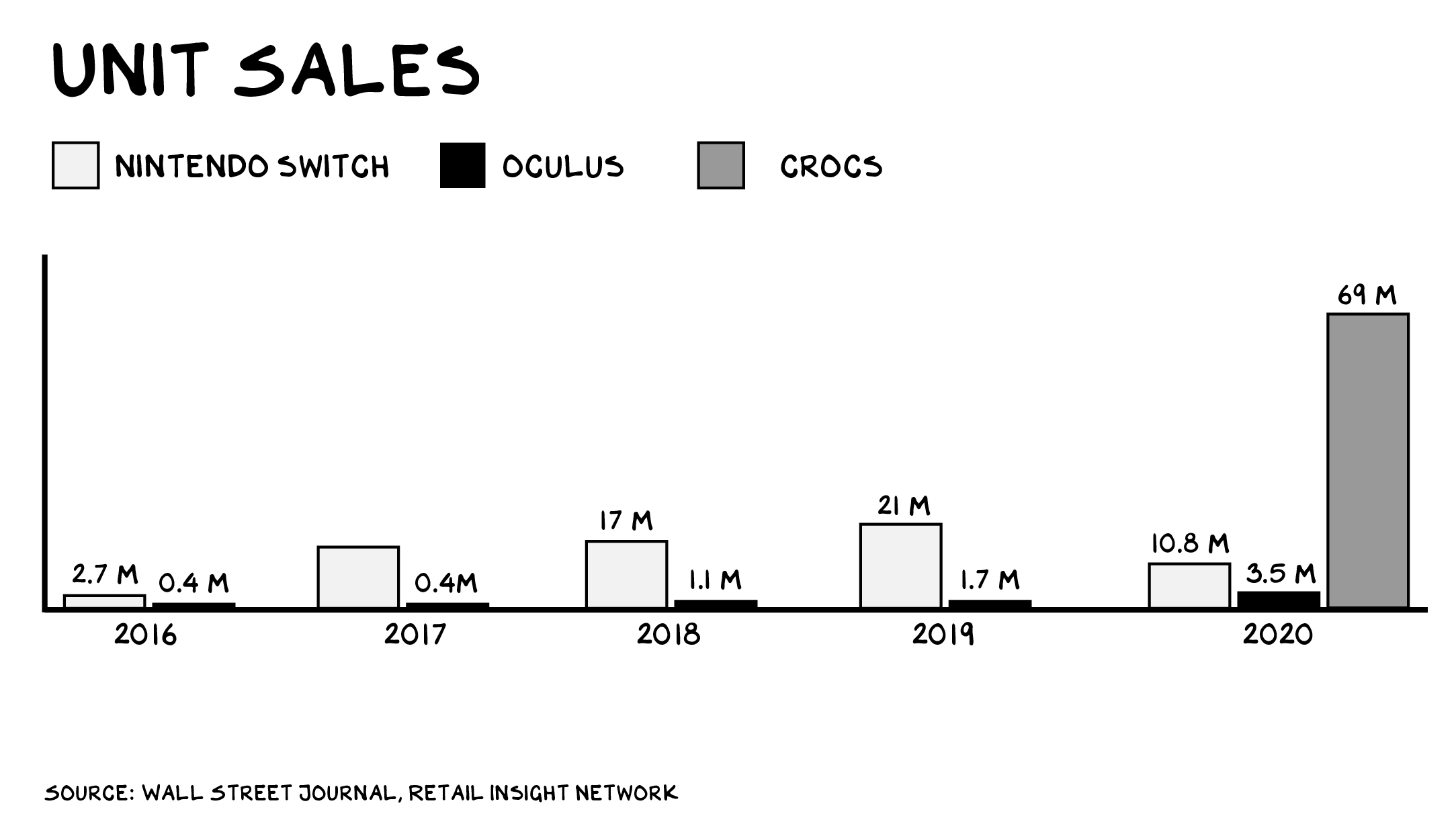

More reasons Facebook’s VR headset is uniquely positioned to fail: It causes motion sickness and skin rashes and prevents other people from having sex with you. It also doesn’t pass the Crocs Test. Whenever a product seems to be garnering a degree of hype incommensurate with its value, ask yourself: Do people like it more than a rubber clog with holes in it? Answer: Not even close. The firm that will realize (some of) this meta vision with what may be the biggest tech IPO of 2022 is Epic Games. Epic is also the best/worst acquisition for Meta/society that should not happen if the DOJ still has a pulse.

Fundamentals and Valuations Reunite

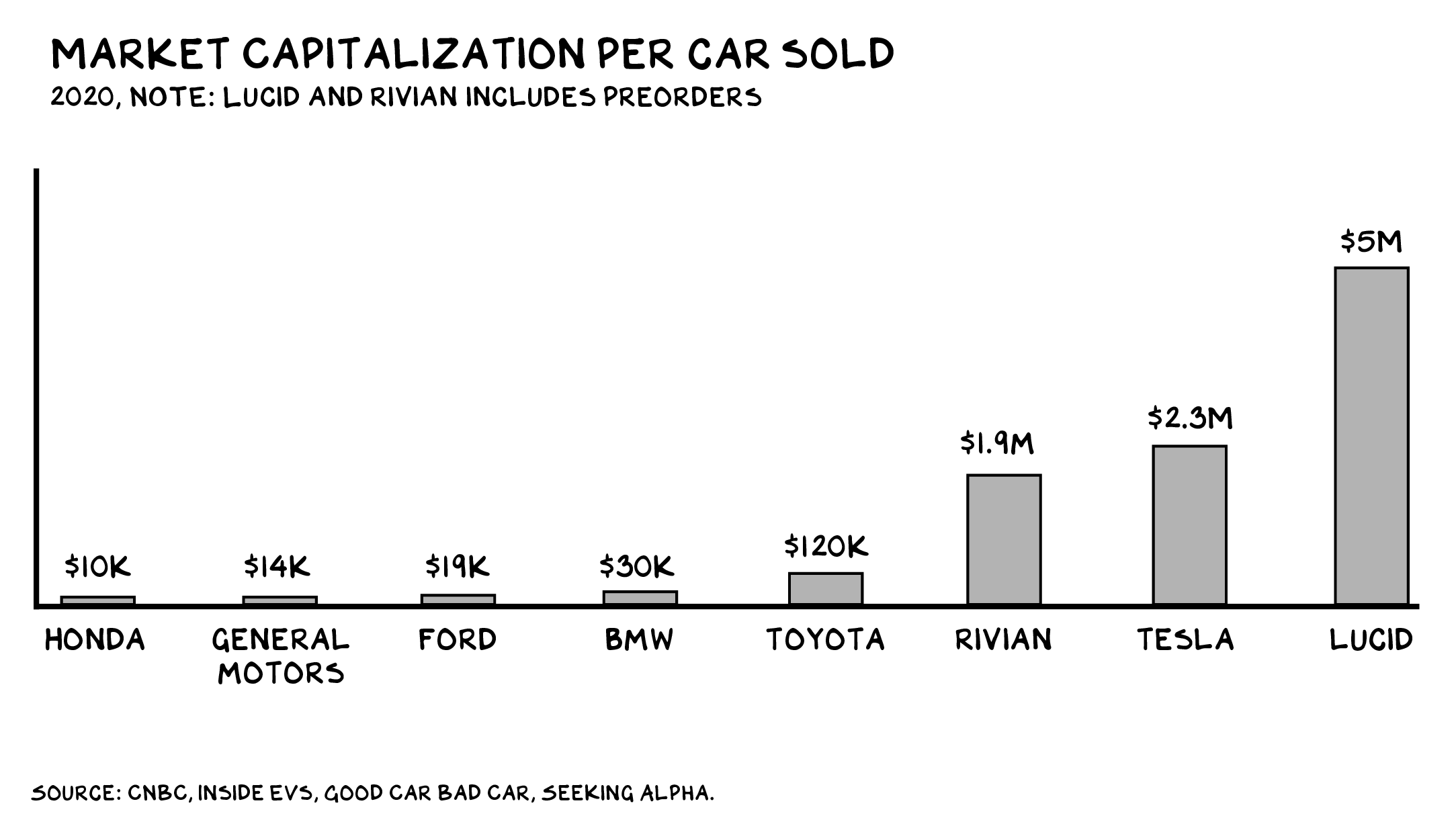

The second-, fourth-, and fifth-most Googled news searches of 2021 were AMC stock, Dogecoin, and GME stock, respectively. GameStop has produced returns this year 28 times greater than the S&P 500; AMC beat it by 38 times. Tesla is the sixth-most valuable company in the world, with an enterprise value 23 times its sales. The fifth-most valuable carmaker in the world, Rivian, hasn’t delivered any vehicles. If 2021 was the year of the bubble, 2022 may be the year of the pop.

The watering hole of hype and speculation should start to run dry this year. Company valuations will begin reuniting with fundamentals and proven business models. Larger-than-life CEOs chasing larger-than-reality total addressable markets will become a point of remorse, not promise. Story stonks and meme coins and the illusory movements behind them will start to spell C-R-A-S-H, not M-O-O-N. As such, we predict that by the end of the year:

- GameStop and AMC’s stocks will be below $10 per share.

- Tesla, Rivian, and Lucid’s stocks will be cut in half.

Bring it, Tesla Taliban. Re Rivian: It’s shaping up to be a great company, like Tesla, and I pre-ordered one — again, like Tesla. (Sidebar: 2018 Falcon Model-X for sale, no reasonable offer refused.) However, when you claim your TAM is solving climate change and register valuations of $1 million-plus per car sold, you’re falling victim to the same dangerous trend ignored over the past two decades: Prioritizing asset values, disconnected from economic growth, over productivity or citizenship.

Nuclear Will Explode

Hollywood has levied destruction on many brands in our society, including high school bullies, axe murderers, and evil emperors. There is one brand, however, that’s been unfairly and problematically tarnished: nuclear energy.

Godzilla was the product of nuclear radiation in the ocean. The Atomic Twister was a fictional tornado whose greatest danger was crashing into a nuclear reactor in Tennessee. The most evil man in Springfield owns the nuclear power plant.

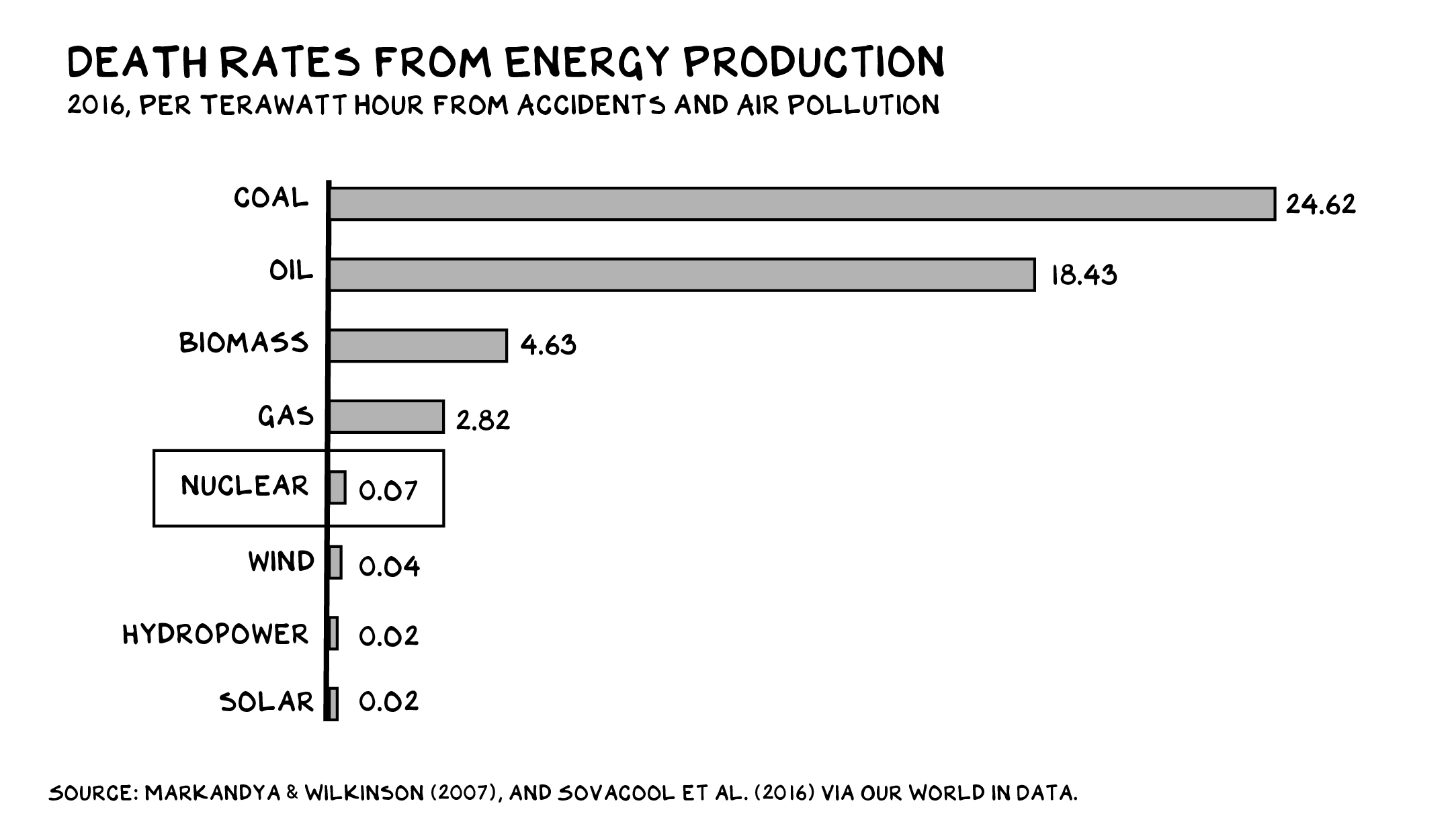

Our apprehension toward this powerful clean-energy source stems from a one-off disaster in Chernobyl (also dramatized as a miniseries). In reality, nuclear power is one of the safest energy sources in the world, registering accident- and pollution-related death rates roughly 300 times lower than those of coal and oil. And it produces no CO2.

But … it has a terrible reputation: 62% of the world population opposes the use of nuclear energy. It’s time to rebrand nuclear. Josh Wolfe believes we should call it “Elemental Energy.”

There’s more where this came from, but we’re saving it for January 4. I’ll be covering, among other things: space travel, NFTs, fintech, and the future of luxury. If you can’t make it (or you just want to watch it again), we’ll send a recording after the event.

Andy Levene

I am going to stay home tonight. Not getting Covid before 2022 is my new Squid Game. I will take pause to contemplate the reward and joy I get from my animals (sons) and beasts (dogs). I will resolve to be stronger, demonstrate grace, and be a positive force in the lives of my sons, as well as young men I have no connection to — as several men did for me growing up. More than anything, I will remember my cousin Andy Levene, who died at 52 earlier this week from Covid complications. Andy was ebullient, handsome, and in perfect health. He chose not to get vaccinated. He is survived by his mother, sister, and 9-year-old son.

I wish for each of you a 2022 full of health, prosperity, and time with loved ones.

Life is so rich,

The post 2022 Predictions appeared first on No Mercy / No Malice.

来源分类:The_english_blog

文章日期:March 14, 2022 at 12:35AM

收藏日期:March 14, 2022 at 12:35AM